GST Identification Number Brings Unified Market in India!

Once GST is implemented it will provide a unique identification number which is also called as GSTIN or GST Identification Number. It is similar to the TIN number which is assigned under VAT law, but it will be under just a single authority. Definitely, this will create a better tax administration and improve collection of taxes.

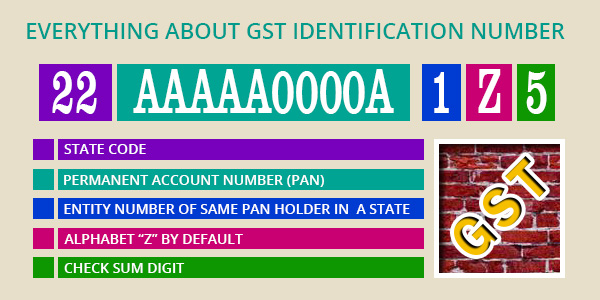

The structure of GSTIN:

- The GSTIN will be a 15 digits long code for all taxpayers.

- The first two digits will explain the state code and next ten digits will be a PAN number of candidates.

- 13th digit will tell the number of registrations a legal firm has within the state.

- 14th digit will be alphabet “z” which is constant for all the GSTIN.

- The last digit will be used as the checksum digit of the total number.

How can you apply for GSTIN?

The taxpayers need not to register again for GSTIN they will be validated through CBDT’s database. This registration is provisional for 6 months and as per the government requirement, candidates can submit relevant data within this duration. This registration is free of cost to everyone.

Profits having GSTIN:

If you are not registered to the GST Identification Number then you cannot collect GST from your customers neither can claim any input taxes credits already paid by him/her.